Article

4 Types of Crypto Tax Software You Should Try

The 2021 tax filing season is here, and you are most likely required to report tax for your crypto assets if you’ve exchanged cryptocurrencies or purchased/sold NFTs in 2021. If you are unsure, the best rule of thumb is to just assume you have to put together a report to prove whether you have a gain or loss that needs to be reported. If you have a loss, that could be great news to reduce the tax you owe.

To make the process of putting together a list of all crypto transactions you made in 2021 easier, we recommend you try out a crypto-specific tax software solution for accurate and automated reporting. While I cannot personally recommend what is best for you, I’ve tested out a few solutions out there to help you evaluate.

For the context, I had crypto activities across Coinbase, Coinbase Pro, and MetaMask in 2021. For all the software solutions I tried below, I used automated sync to pull my data from each service vs using the manual import method.

I used the free access options for the software below; I did not end up becoming a paying customer for any. I’m not sponsored by any of the solutions I reviewed below, and none of the links are affiliated.

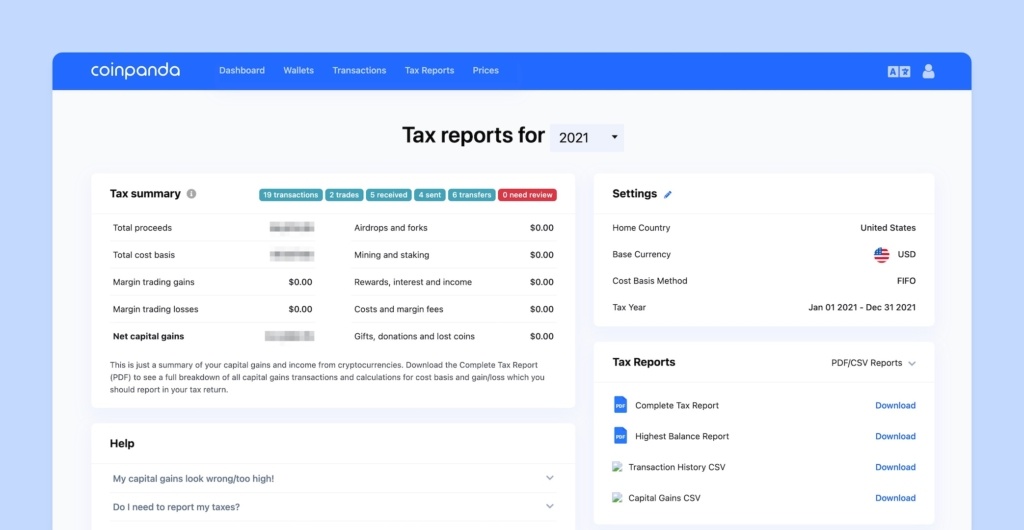

Coinpanda

Coinpanda offers a straightforward experience for connecting your wallets with easy-to-follow documentation. They provide easy-to-understand screens for Dashboard, Wallets, Transactions, and Tax Reports. Because I had fewer than 25 transactions last year, I was able to download the tax report for free in various formats including IRS Schedule D form, transaction history in CSV, etc. Because many of you might fit under low-transaction users, it is worth checking out Coinpanda and getting your report for free.

While I was using the software, I experienced a few server-related issues. I mentioned their issues on Twitter and the support team reached out to me and explained the issue right away.

So if you experience any issues, you can probably count on their support to be available to help you resolve them.

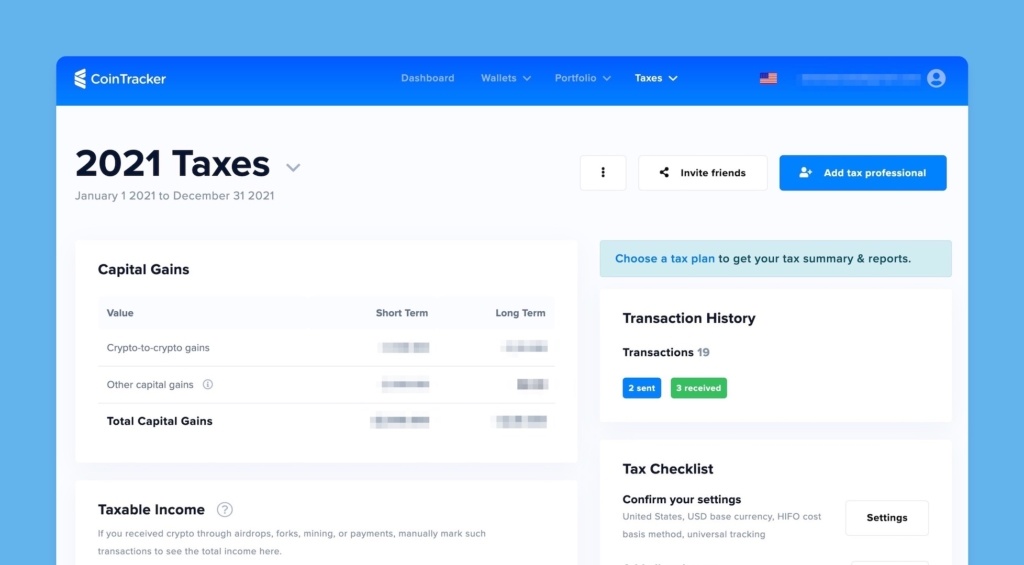

CoinTracker

CoinTracker also provides a simple process for setting up your account and connecting wallets. It offers screens for Dashboard, Wallets, Portfolio, and Taxes. CoinTracker differentiates itself by offering additional features such as the Portfolio screen to track your crypto assets value like investments, and beta features like an NFT Center that displays your NFT collections.

What’s notable is that the crypto exchange giant Coinbase officially endorses CoinTracker on their user help guide. Likewise, CoinTracker also announced its official partnership with Coinbase.

My only complaint with CoinTracker is the fact that it costs me $161.00 USD to view or download the tax report due to DeFi integration. I wish they would at least give free users a gain & loss summary on the website to compare against competitor services. Because I didn’t have that visibility as a free user, I decided not to purchase their premium plan.

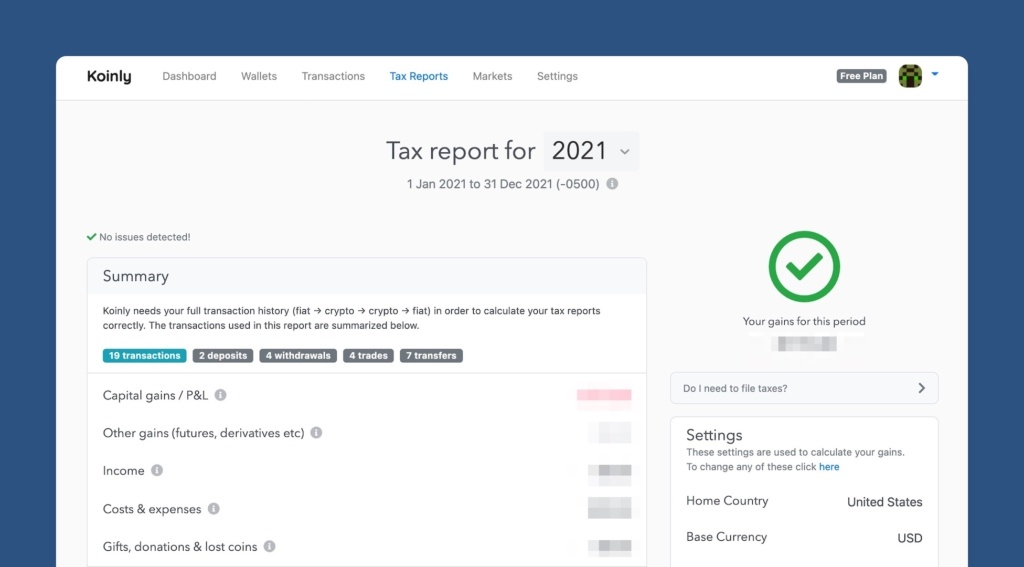

Koinly

Koinly is also a straightforward application where you connect your wallets and get a tax report. Just like Coinpanda, Koinly provides the summary view for free on the web. However, I was prompted to pick one of their paid plans before I could download the report. With Koinly, the cost to download was $49 USD, and they gave an option to pay in one of the supported cryptocurrencies.

The only concern I had was the different summary gains & losses balances reported by Coinpanda and Koinly in the magnitude of thousands of dollars. While it is up to you to evaluate the services for your needs, I recommend reaching out to an account for their expert opinion.

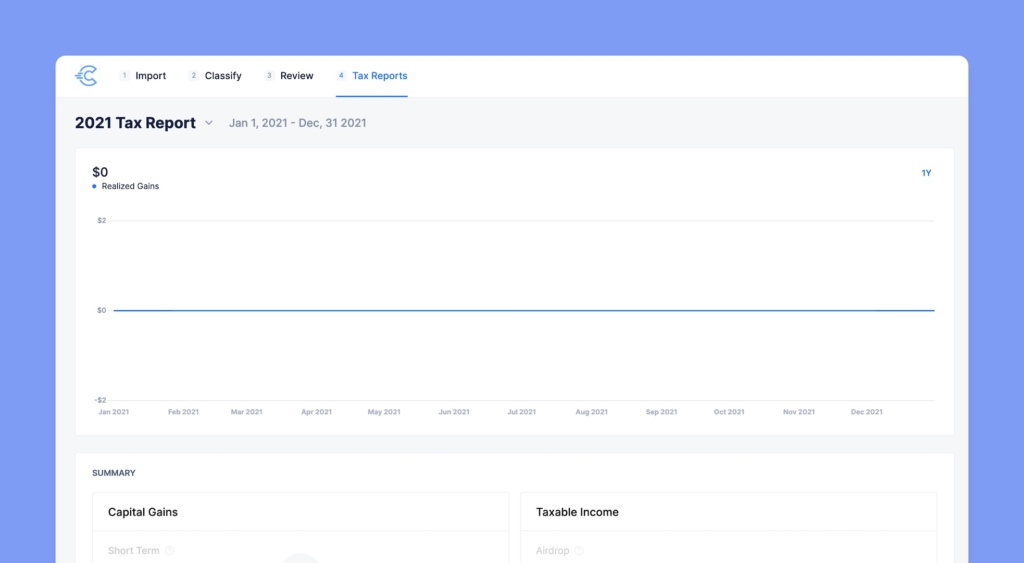

CryptoTrader.tax

CryptoTrader.tax takes a unique approach to walk users through a wizard of Import, Classify, Review, and Tax Reports. Despite their effort to organize screens into a user scenario flow, it ended up being a less straightforward experience for me. For example, the UI is optimized to easily add multiple wallets of the same type, say Coinbase. While it may help advanced power users, it is more straightforward for the average user to be presented with a flow to add a single wallet at a time.

While I experienced no major issue integrating my wallets, CryptoTrader.tax was the only software on this list that did not offer an integration option with MetaMask. I ended up finding an article that explains how to import transaction history from Metamask to CryptoTrader using a manual export and import process. While it may not be a deal-breaker for some, it’s inferior to other solutions that natively support the most popular wallet in the crypto world.

Verdict

As I mentioned earlier, choosing crypto tax software depends on your unique situation—including the number of transactions you have and the types of wallets you need to connect. For most people like me with a low transaction volume, I recommend starting with Coinpanda to leverage their free tier. If you have a larger volume to report and could justify paying at least $49 for crypto tax reporting, you might try other solutions here and see if they meet your unique needs. Because there are issues such as discrepancies between different software solutions, it’s a good idea to get a report and consult with your tax accountant.