Article

Open Banking Opportunities for Innovation

Open banking is redefining bank-to-customer and bank-to-bank relationships

Open banking has experienced exponential growth in recent years, and forecasts show it’s expected to continue.

Banks and other financial institutions use the tech to redefine customer experience and other financial interactions. As the rules are still changing in the US and Central America, the rate of adoption of open banking technologies will vary, but several factors are worth considering as the proliferation of this new model continues.

Open financial ecosystems require strategic collaboration between fintechs and other financial organizations

Strategic partnerships and collaboration between financial institutions and companies from different sectors is vital as open banking technology matures, especially with regard to product development.

- Banks: Banks can benefit from the agile innovation offered by fintechs. Fintechs can benefit equally, collaborating with banks to leverage their data, infrastructure, and regulatory expertise.

- Retailers: Fintechs offer opportunities for seamless payments, personalized financial services, buy-now-pay-later options based on the needs of customers, essential integrations for modern retailers and e-commerce platforms.

- Telecommunications: Telecom companies benefit from fintech enablements like mobile money and digital wallets. This also presents opportunities to foster greater financial inclusion for underbanked populations (see our post on Branch Transformation, with insights on banking deserts and other challenges related to financial inclusivity)

- Healthcare: Fintechs can partner with various institutions in the healthcare industry to offer tailored medtech products, streamlined billing and payment, and consumer-empowering financial planning tools.

User experience is (and will continue to be) a key differentiator for leading open banking tools

The success of open banking tools will be defined by an emphasis on high-quality user experience (UX). If you’re interested in learning more about best practices for UX design, explore our collections of principles for web apps and websites. Specifically related to open banking tools, important UX considerations include:

- Accessibility: In the interest of promoting financial inclusivity, ensuring accessibility and inclusivity for users with disabilities and catering to diverse user groups is crucial.

- Simplicity: Integration of third-party tools creates an even greater need for simple, user-friendly interfaces with minimal complexity, beyond what’s required for the user to complete the task at hand.

- Transparency: Providing users with visibility into how their financial data is being shared and used is imperative. Designers and developers must think through every aspect of a user flow to build trust.

- Integration: Open banking tools should integrate seamlessly with existing banking tools. The aim? Providing a cohesive experience across different platforms and devices.

Leading organizations leverage emerging technologies to enable open banking solutions

Emerging technologies will play a role in delivering on open banking’s promise to improve operational efficiency and enable more personalized financial experiences, all while continuing to place a premium on security. These emerging technologies will factor into the success of open banking use cases:

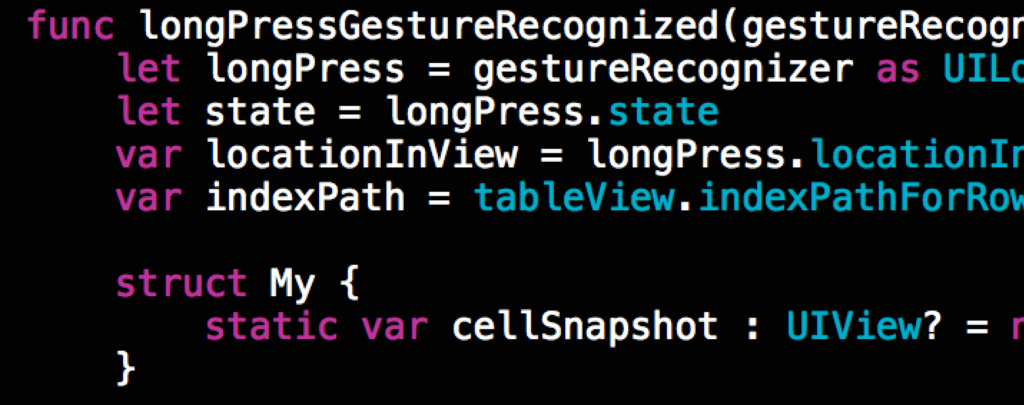

- Application Programming Interfaces (APIs): APIs (as they do in other software applications) enable open banking software programs to draw from the capabilities of other software applications and exchange critical data. This ties to the central value proposition of open banking: enabling secure, standardized communication between different financial systems and services from third-party providers.

- Internet of Things (IoT): IoT and IoT devices play (and will continue to play) a critical role in banking innovation—see our article on smart branches. From enabling personalized financial experiences to smart contracts and automated payments, IoT integrations are a crucial element of open banking use cases.

- Artificial Intelligence (AI) and Machine Learning (ML): AI and ML connects to open banking use cases like detecting fraud, managing risk, and personalizing financial advice for consumers. Consider the use of AI for workflows in other industries as well, where cross-pollination with open banking technology would make sense.

- Blockchain: Alphapoint’s article discusses how blockchain technology enhances open banking transactions (including cross-border payments, smart contracts, and identity verification) creating improved security and transparency. Given the decentralized nature of open banking, additional layers of security enabled by blockchain are crucial.

- Cloud Computing: Cloud technology is essential to enabling the scalability, flexibility, and cost-efficiency required for open banking tools to perform as intended and meet acceptance criteria.

Leaders will continue investing in green banking and socially responsible practices

Staying on track with CSR (corporate social responsibility) and ESG (environmental, social, and governance) goals is vital for modern financial institutions. Open banking solutions can play a role as these organizations seek to deliver on their roadmap for sustainable and ethical practices.

- Accountability & Transparency—Promoting Organizational Credibility: Open banking APIs can be leveraged to monitor an organization’s environmental and social impacts and provide accurate, insightful reporting to stakeholders, consumers, and other decision makers.

- Sustainable Investment Products—Creating More Options for Consumers: Organizations across the spectrum seek to improve their ESG performance and deliver on their promises to consumers. As these organizations seek to do so, sustainable open banking investment products (green bonds, impact funds, etc.) present viable opportunities.

- Ethical Financing and Ethical Lending—Ensuring Follow Through: In the modern financial landscape, transparent and ethical lending practices are vital. Consumers with dozens of financial products to choose from have high expectations and tenuous loyalty. Open banking tools, aligned with ESG principles, can raise the bar for what ethical lending and financing looks like, dually acting as a competitive differentiator.

- Underserved Populations—Promoting Financial Inclusion: Underserved communities deserve access to affordable financial services. Enabling economic empowerment and social mobility benefits the entire financial apparatus, and institutions that invest in open banking can play a leadership role by diversifying the products and services available to customers across the spectrum.

Enhanced security and privacy are vital prerequisites for success

In the UK, open banking solutions continue to be adopted due to their convenience and safety. But the success of open banking as a whole is due in large part to a mature regulatory environment. As open banking gains greater traction in North America, prioritizing security and privacy will be critical.

Baselines to follow include:

- Including Multi-factor Authentication (MFA): Multi-factor authentication mechanisms (one-time passwords, biometrics, etc.) prevent unauthorized access to accounts and services, a bare minimum requirement for fintech tools.

- Ensuring Secure APIs and Data Sharing Protocols: OAuth 2.0 and OpenID Connect ensure data is appropriately shared and coheres to secure authentication and authorization practices.

- Enabling Consent Management: Consent mechanisms empower users to control how their data is shared and used. Developing clear and transparent institutional principals is vital.

- Protecting Data via Encryption and Tokenization: Encrypt data in transit and at rest.

- Adherence to Guidelines for Regulatory Compliance: The Gramm-Leach-Bliley Act (GLBA), General Data Protection Regulation (GDPR), and other standards are important to remain current with.

Asset tokenization will continue taking shape in the coming months and years

Asset tokenization enables the digital representation of assets. This opens up new opportunities for trade, in addition to creating greater investment access. Open banking opportunities to consider include:

- Blockchain Technology: A secure, transparent ledger for recording and tracking the exchange of tokenized assets is vital in decentralized open banking environments.

- Digital Representation: Physical assets are represented as blockchain-based digital tokens, tradable and transferable just like traditional financial assets. The flexibility and seamlessness enabled via this new form of trade and transfer opens up a new frontier in the financial space.

- Tokenization & Fractional Ownership: Asset fractionalization—“dividing high-value assets into smaller, more manageable units known as tokens”—allows multiple investors to own a portion of an asset, presenting opportunities to increase liquidity and create greater investment access.

- “Transparency” and “Immutability”: Ownership and transaction history of tokenized assets within a blockchain are accurately recorded and verifiable. This has the potential to reduce fraud and manipulation risks.

- Smart Contracts: Smart contracts—“self-executing program that automates the actions required in a blockchain transaction”—enforce the terms and conditions of asset tokenization. When it comes to ownership transfers, payments, and asset management, this drastically reduces the probability of human error or influence from bad actors.

Ever-evolving regulations are vital to keep an eye on

As open banking adoption continues, new challenges and risks will inevitably emerge. Regulations must adapt to address this, with new and existing regulatory bodies introducing protective measures that balance innovation with consumer protection.

Expect adaptations like:

- Existing Regulations Updated to Meet New Challenges: Established guidelines for secure data sharing and third-party access, including the UK’s Open Banking Implementation Entity (OBIE) and the European Union’s revised Payment Services Directive (PSD2), are critical. Regulators will continue reviewing and updating regulatory infrastructure as the financial landscape changes.

- Introducing New Regulations: Consumers expect greater control over their data, which will promote healthy competition in the financial sector. With the continued onset of AI, the future will be fluid.

- “Sandboxes and Innovation Hubs”: The European Securities and Market Authority offers an insightful report on what to expect. These environments provide opportunities for fintechs and financial institutions to explore open banking solutions while remaining compliant with regulations.

- Promoting Standardization: Standardization is critical across a range of industries. Ensuring interoperability and consistency within the open banking ecosystem is equally critical, and organizations that take part in writing and establishing industry standards can define themselves as leaders.

- Enabling Consumer Education and Promoting Awareness: Innovators in the open banking space hold the responsibility to help individuals understand open banking’s benefits and risks. Consumer education and awareness campaigns are vital, and will factor into whether or not consumers adopt a new way of banking.

Open banking and fintech innovation: infinite opportunity guided by sound strategy

Open Banking in 2024 promises to be a fertile ground for innovation and collaboration. Financial institutions that embrace these trends will be better positioned to offer more efficient, personalized, and customer-centric services in this exciting new chapter of financial evolution.

If you’re interested in learning more or connecting to solve a challenge, don’t hesitate to reach out!

[This article is an expansion on a post written by our friends at Atomic 32, which Fresh recently acquired—see the press releases in English and Spanish]